Rising more than 150 per cent from February, the amount lost in March also represents a significant increase of nearly 400 per cent from the $20 million reported the same time last year. Despite an increase in the amount lost to scams, the number of reports decreased by 10 per cent in March, with 16,446 scams recorded suggesting scammers are becoming more effective in their tactics with far less attempts.

Investment scams were the single greatest source of money loss in March totalling $82 million – more than three times higher than the previous monthly record of $27 million in February. Men were significantly more impacted by investment scams, accounting for 92 per cent.

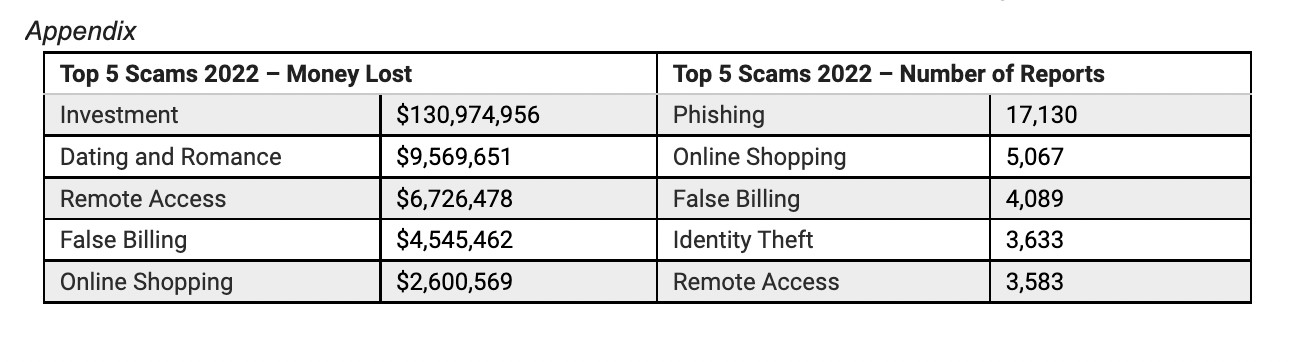

Additionally, phishing scams were the type of scams most recorded, which echoes data from Proofpoint’s latest report, 2022 State of the Phish where it was reported that email-based attacks dominated the threat landscape in Australia in 2021 – with 90 per cent or more of Australian survey respondents said their organisation faced spear phishing, BEC (business email compromise) and email-based ransomware attacks in 2021.

Key findings in March:

- Australians aged 25 to 34 were the most impacted with losses totalling $65 million for this age group.

- Queensland residents suffered the greatest losses at $67 million, followed by NSW at $11 million.

- Mobile app scams were the greatest method of losing money, totalling $65 million or 68 per cent of all losses.

- Phone scams accounted for the greatest number of reports at 6,135 or 37 per cent.

- Phishing scams were the type of scam most recorded with 4,773 reports.

- Men were disproportionately affected accounting for 87 per cent of all money lost in March.

- Australians have already lost $167 million to scams so far this year compared to $323 million lost throughout the whole of 2021.

The latest figures demonstrate just how damaging scams can be and the impact they are continuing to have on Australians, according to Crispin Kerr, vice president, ANZ at Proofpoint.

“As the data shows, investment scams continue to be the most profitable and one of the most attractive scams due to the promise of quick cash and money wins.

“Younger Australians especially are most susceptible to these scams which can range from cryptocurrency scams, celebrity endorsements to unsolicited phone calls promising an investment opportunity like shares or stocks.

“The rising popularity of cryptocurrency is likely contributing to the increase in investment scam losses and activity,” Kerr said.

Proofpoint’s tips to avoid being scammed:

- Never share personal or financial information including bank account or credit card details with someone you don’t know.

- Do not click through links or open attachments from unknown senders whether that’s over email, text, social media or online.

- Look out for spelling and grammatical errors, these can suggest a message is a scam.

- Only communicate with an organisation through official channels found on company websites, do not reply directly to emails.

- Do not share passwords with people and ensure you change these regularly.

- Consider using a password manager to help protect your personal information from being stolen.

- Be cautious about phone calls or emails that come out of the blue with investment offers or travel and other prizes.

Kerr further explains that Australians need to be extra vigilant especially when interacting with people they don’t know online and over the phone.

“Scammers are becoming increasingly convincing and will go to great lengths to form relationships to appear legitimate, convincing Australians to hand over personal and financial information.

“Always seek financial advice if you are looking at making an investment and only do so through reputable channels.

“Knowing how to spot a scam is an important first defence and one of the best things people can do to protect themselves.”

Cryptocurrency is another avenue for criminals to exploit Australians and take advantage of a less regulated environment where digital currencies are more difficult to track.

Cyber criminals have become more sophisticated, even setting up fake cryptocurrency exchange platforms to carry out cryptojacking, tricking people into using their computers and mobile devices to mine cryptocurrency against the user’s will.

“Remember, if something looks or sounds too good to be true, it almost always is,” Kerr concluded.

[Related: AUSTRAC works with businesses to counter cyber-enabled crime]